Top 10 Balance Transfer Credit Cards in London

1. NatWest’s No-Fee Balance Transfer Credit Card

This is the longest no-fee balance transfer credit card in the United Kingdom. There are lots of key features in these credit card holders. This is one of the best no-fee balance credit cards in the United Kingdom. This credit card offers 22 months interest-free. These offers are only available to existing NatWest customers. In this credit card, 21.9% representative APR is there.

2. Sainsbury Bank’s Low-Fee Balance Transfer Credit Card

This is one of the best Low-fee balance transfer credit cards in the United Kingdom. In this credit card, a 21.9% representative annual percentage rate is there. In this low-fee balance transfer, you could pay a 1% fee depending on your credit card details as well as your fee and interest-free period depending on your credit card source. This bank has a 0% interest rate on purchases for your first 3 months and no annual fee for this credit card customer.

You can pay your money through apple pay and google pay.

3. Santander Everyday

In this credit card, there is a long no-fee deal with a low annual percentage rate. There are lots of key features in this credit card holder such as a no-balance transfer fee, a 21-month balance transfer fee period, and this credit card holder’s 21.9% representative annual percentage rate is there. This credit card is ranked 22nd out of 30 credit card providers. But one drawback is when it comes to transparency and complaint they work a little poorly performance.

4. Sainsbury’s 34-Month Transfer Credit Card

This credit card is, the longest zero percentage deal available, but with a fee. For this credit card holders from starting to 34-month balance transfer period are available. In this credit card holder, a 21.9% representative annual percentage rate is there. Who needs a long credit card period, this could be the best option for those people. Here, 2.88 percentage or 3.88 percentage transfer fee.

In this bank, 0% interest rate on purchases for your first 3 months and there is no annual fee for this credit card customers. You can pay your money through apple pay and google pay.

5. Santander Everyday Long-Term Balance Transfer Credit Card

This is the 33-month balance transfer period offer. You can take this balance transfer credit card if you wish for long-term payment. There are lots of key features in this credit card holder such as a no-balance transfer fee, a 33-month balance transfer fee period cash flow, and this credit card holder’s 21.9% representative annual percentage rate is there. This credit card is ranked 22nd out of 30 credit card providers.

But one drawback is when it comes to transparency and complaint they work a little poorly performance.

Features:

- Representative – 21.9% Annual Percentage Rate (it will vary)

- Purchase Rate – 21.9% p.a.

- Assumed Credit Limit – £1200

- Monthly Fee – £0

6. Virgin Money 33-Month Balance Transfer Credit Card

This credit card is, the longest zero percentage deal available, but with a fee. There are lots of key features in this credit card holder such as no-balance transfer fee, 33-month balance transfer fee period, and for this credit card holder, 21.9% representative annual percentage rate is there as well as 3 months 0 percentage on purchases. One of the main features of this credit card, is 12 months 0% on money transfers.

You can take this balance transfer credit card if you wish for long-term payment.

7. HSBC 33-Month Balance Transfer Credit Card

In this HBSC bank, you can choose between your loan tenures of 3 months, 6 months, 9 months, 12 months, 18 months, and 24 months. For every tenure the rate of interest between 10.99 % to o15.99 % p.a. HSBC credit card holders, the balance transfer fee was 2.84% (actually minimum £5). For these credit card holders, a 21.9% representative annual percentage rate is there as well as 3 months 0 percentage period on purchases.

8. M & S Bank

This credit card is, the longest zero percentage deal available, but with a fee. These M & S bank cards also have a zero percent interest on purchases in the first 3 months. You can get reward vouchers also. This is one of the topmost important banks for balance transfer credit cards.

Features:

- Zero percentage balance transfer period for 32 month

- 99 percentage fee (actually minimum £5)

- Annual percentage rate – 21.9 percentage

9. Tesco Bank Balance Transfer Card

This balance transfer credit card has the longest zero percentage deal, but with a fee. This bank balance transfer card should make you an important shortlist if you want a long transfer period. Now, this bank improved a lot. The customers can now benefit from up to 33 months of interest fee. This banks also rant as the best bank for customer service. This bank was awarded a gold ribbon in customer experience rankings.

Features:

- This card has up to 33 months zero percent balance transfer period

- 59 percentage fee (minimum £5)

- Annual percentage rate – 21.9 percentage

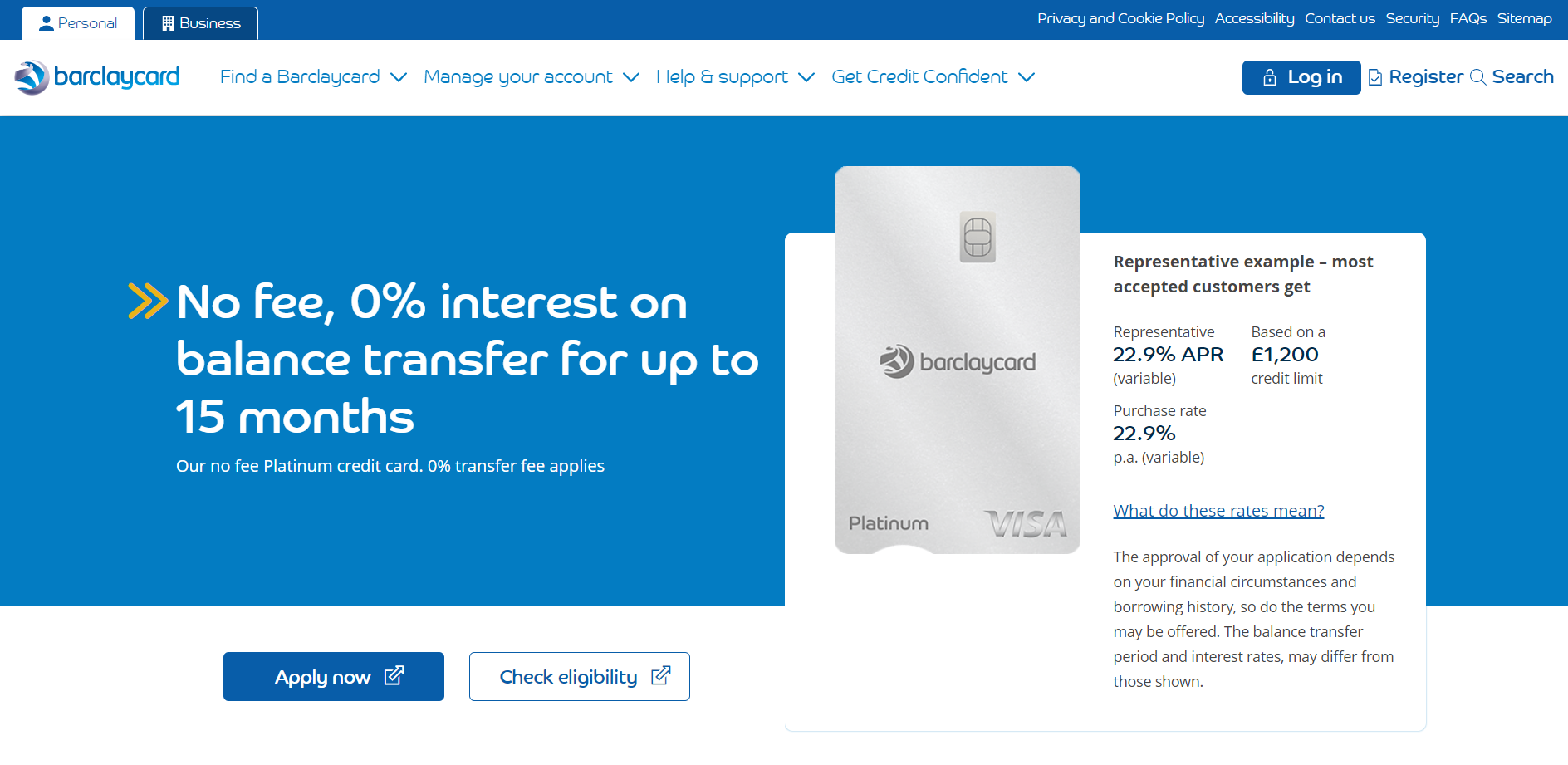

10. Barclaycard No Fee Platinum Card

This is one of the best no-fee platinum balance transfer credit cards in the United Kingdom. This balance transfer credit card has the longest zero percentage deal, but with a great customer experience. The fourth longest zero percentage duration among fee-free cards is “the no-cost platinum balance transfer card” from Barclaycard. For these credit card holders, a 21.9% representative annual percentage rate is there as well as 3 months 0 percentage period on purchases.

Features:

- Balance transfer period for 15 months.

- No balance transfer fee

- Annual percentage rate – 21.9 percentage

Leave feedback about this